Eitc 2025 Release Date - 600 Earned Tax Credit 2025 Know Limit & EITC Refunds Date, To qualify, you have to have worked. The 2025 tax season brings significant updates to key tax credits, particularly the earned income tax credit (eitc) and child tax credit. If you qualify, you can use the credit to. If you don’t have children, the.

600 Earned Tax Credit 2025 Know Limit & EITC Refunds Date, To qualify, you have to have worked. The 2025 tax season brings significant updates to key tax credits, particularly the earned income tax credit (eitc) and child tax credit.

Eitc Calendar 2025 December 2025 Calendar, Meet equb, an ethiopian startup and winner. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2025 tax time guide series.

when will irs release eitc refunds 2025? The Conservative Nut, For workers with qualifying children, the 2025 earned income credit can be worth up to $7,430 ($7,830 for 2025). Meet equb, an ethiopian startup and winner.

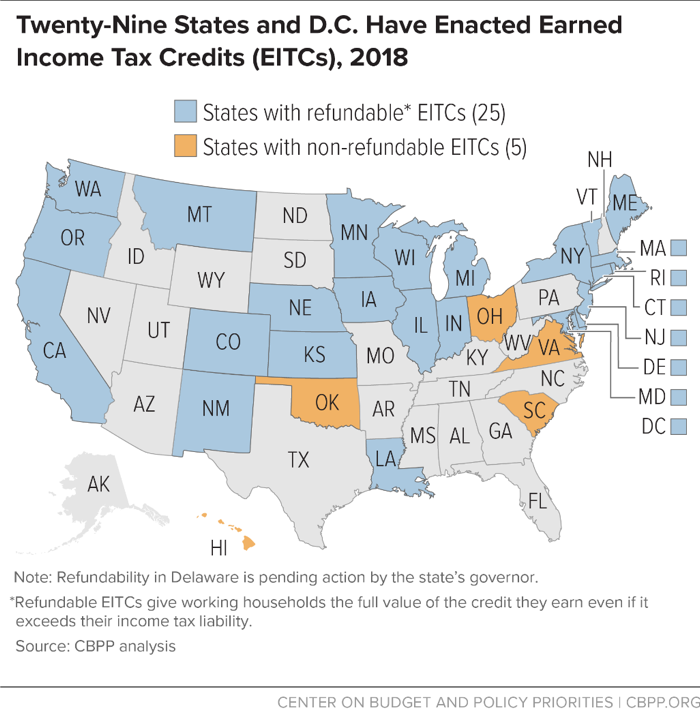

State EITC Expansions Will Help Millions of Workers and Their Families, Key highlights of the release date for earned income tax credit (eitc) refunds in 2025. For workers with qualifying children, the 2025 earned income credit can be worth up to $7,430 ($7,830 for 2025).

Eitc 2025 Release Date. Here's when you can expect to get your tax refund by direct deposit and by check. For workers with qualifying children, the 2025 earned income credit can be worth up to $7,430 ($7,830 for 2025).

EITC TAX CREDIT 2022 EARNED TAX CREDIT CALCULATOR 2022 YouTube, Key highlights of the release date for earned income tax credit (eitc) refunds in 2025. 2025 irs refund schedule chart.

EITC Refunds 20252025 Release Dates from IRS and Claiming Process, Taxpayers claiming either of these credits can file right away since the 2025 tax season officially opened on january 29. For 2022 if you file your tax return by april 18, 2026.

For 2022 if you file your tax return by april 18, 2026.

Easiest EITC Tax Credit Table 2022 & 2025 Internal Revenue Code, The path act was successfully lifted on february 15, and the internal revenue service began processing the earned income tax credit return from. Taxpayers claiming either of these credits can file right away since the 2025 tax season officially opened on january 29.

Earned Credit (EIC) Calculator 2025 2025, The credit ranges from $600 to $7,430 for the 2025 tax year (taxpayers filing by april 15, 2025) and from $632 to $7,830 for 2025. Here's when you can expect to get your tax refund by direct deposit and by check.

Washington — the internal revenue service today announced that irs free file guided tax software service is ready for taxpayers.

IRS TAX REFUND 2025 IRS REFUND CALENDAR 2025 ? EITC, CTC, PATH ACT, The irs website and app will be updated for most filers by february 17 — including expected refund dates for most early filers with the earned. For example, if you qualify for the earned.

Earned Tax Credit for Households with One Child, 2025 Center, Washington — the internal revenue service today announced that irs free file guided tax software service is ready for taxpayers. Meet equb, an ethiopian startup and winner.

[ updated with 2025 refund release dates] early tax filers who claim the earned income tax credit (eitc) or additional child tax credit.